Final Checklist Before Submitting Mortgage Loan Application: 10 Ultimate Steps

Submitting a mortgage loan application is a pivotal moment in your home-buying journey. Get it right with this ultimate final checklist before submitting mortgage loan application to ensure approval and peace of mind.

1. Verify Your Credit Score and Report Accuracy

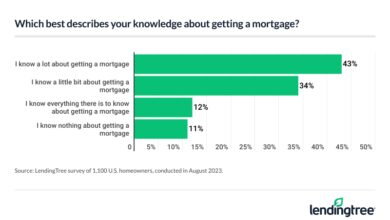

Your credit score is one of the most critical factors lenders evaluate when reviewing your mortgage application. A strong score can secure better interest rates and loan terms, while errors or low scores can delay or derail your approval. Before you submit your application, it’s essential to obtain and review your credit report thoroughly.

Check Your Credit Score from All Three Bureaus

The three major credit reporting agencies—Equifax, Experian, and TransUnion—each maintain their own version of your credit history. These reports may differ slightly, so it’s wise to request all three. You can access your free credit reports once per year at AnnualCreditReport.com, a government-authorized site.

final checklist before submitting mortgage loan application – Final checklist before submitting mortgage loan application menjadi aspek penting yang dibahas di sini.

- Review each report for inconsistencies or outdated information.

- Compare scores across bureaus to identify discrepancies.

- Note any accounts you don’t recognize or late payments you believe are inaccurate.

“Your credit score can make or break your mortgage approval. Don’t assume it’s perfect—verify it.” — Consumer Financial Protection Bureau (CFPB)

Dispute Errors Immediately

If you find errors—such as incorrect balances, accounts that aren’t yours, or late payments that were actually on time—you should file a dispute with the respective credit bureau. The dispute process can take 30 to 45 days, so act quickly. Submit documentation like payment receipts or account statements to support your claim.

- Use the online dispute tools provided by each bureau.

- Send disputes via certified mail for tracking purposes.

- Follow up within 30 days to ensure resolution.

Correcting errors can boost your score and improve your chances of qualifying for favorable loan terms. Remember, even a 20-point increase can significantly reduce your interest rate over the life of the loan.

2. Gather and Organize All Required Financial Documents

Lenders require extensive documentation to verify your income, assets, debts, and overall financial health. Preparing these documents in advance is a crucial part of the final checklist before submitting mortgage loan application. Missing or incomplete paperwork is one of the top reasons for application delays.

final checklist before submitting mortgage loan application – Final checklist before submitting mortgage loan application menjadi aspek penting yang dibahas di sini.

Proof of Income: Pay Stubs, W-2s, and Tax Returns

Lenders typically require the last two years of federal tax returns, including all schedules, and recent pay stubs (usually the last 30 days). If you’re self-employed, you may need to provide additional documentation such as profit-and-loss statements or 1099 forms.

- Ensure W-2s and tax returns match your current employment status.

- Highlight any bonuses, commissions, or overtime income that’s consistent.

- Be ready to explain gaps in employment or income fluctuations.

For self-employed borrowers, lenders often average your income over the past two years. Make sure your tax returns reflect a stable or growing income trend. If you’ve recently started a business, be prepared to provide extra documentation to prove sustainability.

Asset Statements: Bank, Investment, and Retirement Accounts

Lenders want to see that you have sufficient funds for your down payment, closing costs, and reserves. You’ll need to provide recent statements (typically the last two to three months) for all your accounts, including checking, savings, brokerage, and retirement accounts.

final checklist before submitting mortgage loan application – Final checklist before submitting mortgage loan application menjadi aspek penting yang dibahas di sini.

- Ensure all accounts are in your name or jointly held with your co-applicant.

- Highlight large deposits and be ready to explain their source (e.g., gift, sale of asset).

- Avoid opening new accounts or making large withdrawals during the application process.

If you’re receiving a gift for your down payment, you’ll need a signed gift letter from the donor. This letter should state that the money is a gift, not a loan, and include the donor’s contact information and relationship to you. The donor may also need to provide proof of funds.

3. Confirm Employment and Income Stability

Lenders look for consistent and reliable income. Even if you’ve been employed for years, a recent job change or freelance work can raise red flags. Confirming your employment status is a vital step in the final checklist before submitting mortgage loan application.

Steady Employment History Matters

Most lenders prefer to see at least two years of continuous employment in the same field. Frequent job changes or gaps in employment may require additional explanation. If you’ve recently changed jobs, ensure that your new position is in the same or a related industry and that your income is stable or increasing.

final checklist before submitting mortgage loan application – Final checklist before submitting mortgage loan application menjadi aspek penting yang dibahas di sini.

- Provide a letter from your employer confirming your position, salary, and employment status.

- If you’re in a probationary period, wait until it’s completed before applying.

- Avoid changing jobs during the mortgage process, as this can jeopardize approval.

For those in commission-based or variable-income roles, lenders may average your earnings over the past two years. Consistency is key—large swings in income can make you appear riskier to lenders.

Self-Employed Borrowers: Extra Scrutiny Applies

If you’re self-employed, lenders will scrutinize your income more closely. They typically require two years of tax returns and may calculate your qualifying income by averaging your net profit. Be prepared to show business licenses, contracts, or client lists to demonstrate stability.

- Work with a mortgage broker familiar with self-employed borrowers.

- Consider increasing your down payment to offset perceived risk.

- Avoid taking on new business debt during the application period.

Some lenders offer alternative documentation loans for self-employed individuals, but these often come with higher interest rates or stricter requirements. Research your options early.

final checklist before submitting mortgage loan application – Final checklist before submitting mortgage loan application menjadi aspek penting yang dibahas di sini.

4. Review and Reduce Outstanding Debts

Your debt-to-income (DTI) ratio is a key metric lenders use to assess your ability to manage monthly payments. A high DTI can disqualify you from a mortgage, even if your credit score is excellent. Reducing your debts before applying is a smart move in the final checklist before submitting mortgage loan application.

Calculate Your Debt-to-Income Ratio

Your DTI ratio is calculated by dividing your total monthly debt payments by your gross monthly income. Most lenders prefer a DTI of 43% or lower, though some programs allow up to 50% for qualified borrowers.

- Add up all monthly debt obligations: credit cards, car loans, student loans, child support, etc.

- Divide the total by your gross monthly income (before taxes).

- Use online DTI calculators to estimate your ratio.

For example, if your monthly debts total $2,500 and your gross income is $6,000, your DTI is 41.7%—within the acceptable range. If it’s higher, consider paying down balances before applying.

final checklist before submitting mortgage loan application – Final checklist before submitting mortgage loan application menjadi aspek penting yang dibahas di sini.

Pay Down High-Interest Debt Strategically

Focusing on high-interest credit card debt can have a dual benefit: it lowers your DTI and improves your credit utilization ratio, which is a component of your credit score. Aim to keep your credit card balances below 30% of your credit limit.

- Use the snowball or avalanche method to prioritize debt repayment.

- Avoid closing credit card accounts after paying them off, as this can reduce your available credit and hurt your score.

- Do not take on new debt during the mortgage process.

“Paying off debt isn’t just about numbers—it’s about proving financial responsibility to lenders.” — National Foundation for Credit Counseling

Even a small reduction in your DTI can improve your chances of approval and help you qualify for better loan terms. Consider delaying large purchases like a new car or furniture until after your mortgage is secured.

5. Finalize Your Down Payment and Closing Cost Funds

One of the most tangible parts of the final checklist before submitting mortgage loan application is ensuring you have enough money for your down payment and closing costs. These funds must be “seasoned,” meaning they’ve been in your account for a certain period, typically 60 days, to prove they’re not borrowed.

final checklist before submitting mortgage loan application – Final checklist before submitting mortgage loan application menjadi aspek penting yang dibahas di sini.

Determine Exact Down Payment Requirements

The required down payment varies by loan type. Conventional loans typically require 5% to 20%, FHA loans as low as 3.5%, and VA or USDA loans may require no down payment. Know your loan program’s requirements and ensure you meet them.

- Save more than the minimum to avoid private mortgage insurance (PMI) if possible.

- Use down payment assistance programs if eligible.

- Confirm with your lender whether gift funds are allowed and what documentation is needed.

Keep in mind that a larger down payment reduces your loan amount, lowers monthly payments, and may improve your interest rate. It also demonstrates financial discipline to lenders.

Budget for Closing Costs and Reserves

Closing costs typically range from 2% to 5% of the loan amount and include fees for appraisal, title search, attorney, and lender charges. You should also have reserves—enough money to cover 2 to 6 months of mortgage payments—in case of emergencies.

final checklist before submitting mortgage loan application – Final checklist before submitting mortgage loan application menjadi aspek penting yang dibahas di sini.

- Ask your lender for a Loan Estimate to see a breakdown of expected costs.

- Compare offers from multiple lenders to find the best deal.

- Set aside funds in a liquid, accessible account.

Some lenders allow you to roll closing costs into the loan or accept lender credits, but this may increase your interest rate. Weigh the pros and cons carefully.

6. Choose the Right Mortgage Lender and Loan Type

Not all lenders are created equal. Selecting the right one can save you thousands over the life of your loan. This step is a critical component of the final checklist before submitting mortgage loan application. Your choice affects interest rates, fees, customer service, and approval speed.

Compare Multiple Lenders and Loan Offers

Never settle for the first lender you speak with. Get pre-approved by at least three lenders and compare their Loan Estimates. Pay attention to the interest rate, origination fees, discount points, and APR (Annual Percentage Rate), which includes both interest and fees.

final checklist before submitting mortgage loan application – Final checklist before submitting mortgage loan application menjadi aspek penting yang dibahas di sini.

- Use online comparison tools like Bankrate or Zillow to research lenders.

- Check customer reviews on sites like the Better Business Bureau or Google.

- Ask friends or real estate agents for recommendations.

Pre-approval letters from multiple lenders also give you negotiating power when making an offer on a home. They show sellers you’re serious and financially capable.

Understand Different Loan Types and Terms

There are several mortgage options, each with pros and cons. Common types include fixed-rate, adjustable-rate, FHA, VA, and USDA loans. Choose the one that best fits your financial situation and long-term goals.

- Fixed-rate mortgages offer stable payments over 15 or 30 years.

- Adjustable-rate mortgages (ARMs) start with lower rates but can increase over time.

- Government-backed loans offer lower down payments and flexible credit requirements.

Discuss your options with a mortgage advisor. For example, if you plan to stay in the home for less than 10 years, an ARM might save you money. If you want stability, a 30-year fixed is often the best choice.

final checklist before submitting mortgage loan application – Final checklist before submitting mortgage loan application menjadi aspek penting yang dibahas di sini.

7. Conduct a Final Review of Your Application Before Submission

The last and most crucial step in the final checklist before submitting mortgage loan application is a thorough review of all your information. A single typo or missing document can delay processing or lead to denial. Treat this step with the seriousness it deserves.

Double-Check All Personal and Financial Information

Review every field in your application: name, address, Social Security number, employment history, income, and asset details. Even a minor error—like a transposed digit in your phone number—can trigger verification delays.

- Cross-reference your application with your supporting documents.

- Ensure all names match exactly across documents (e.g., middle name included or omitted).

- Verify dates of employment and income figures.

Ask a trusted friend or family member to review your application with fresh eyes. They might catch something you’ve overlooked.

final checklist before submitting mortgage loan application – Final checklist before submitting mortgage loan application menjadi aspek penting yang dibahas di sini.

Confirm Document Completeness and Format

Lenders have specific requirements for document format—usually PDF or JPEG, with clear, legible text. Make sure all pages are included, especially the front and back of statements, and that nothing is cut off.

- Label files clearly (e.g., ‘Paystubs_Jan2024.pdf’).

- Submit documents through secure portals, not email.

- Keep a copy of everything you send.

Some lenders use automated underwriting systems that flag missing or mismatched data instantly. A complete, well-organized submission increases your chances of a smooth approval process.

What happens if I make a mistake on my mortgage application?

final checklist before submitting mortgage loan application – Final checklist before submitting mortgage loan application menjadi aspek penting yang dibahas di sini.

Mistakes can delay your application or lead to denial. Minor errors may be corrected with clarification, but major inaccuracies—like inflating income—can be considered fraud. Always be honest and thorough.

How long does the mortgage approval process take?

Typically, it takes 30 to 45 days from application to closing. However, delays in document submission, appraisal issues, or underwriting problems can extend the timeline.

final checklist before submitting mortgage loan application – Final checklist before submitting mortgage loan application menjadi aspek penting yang dibahas di sini.

Can I apply for a mortgage with a low credit score?

Yes, but your options may be limited. FHA loans accept scores as low as 580 with a 3.5% down payment. Some lenders offer special programs for borrowers with lower credit, though rates may be higher.

Should I get pre-approved before house hunting?

final checklist before submitting mortgage loan application – Final checklist before submitting mortgage loan application menjadi aspek penting yang dibahas di sini.

Absolutely. Pre-approval strengthens your offer, shows sellers you’re serious, and helps you understand your budget. It’s one of the first steps in the home-buying process.

Can I use retirement funds for my down payment?

Yes, but with caveats. You can withdraw from a Roth IRA penalty-free for a first-time home purchase (up to $10,000). Traditional IRAs allow withdrawals but may incur taxes and penalties. Consult a financial advisor before tapping retirement savings.

final checklist before submitting mortgage loan application – Final checklist before submitting mortgage loan application menjadi aspek penting yang dibahas di sini.

Completing the final checklist before submitting mortgage loan application is not just about ticking boxes—it’s about setting yourself up for long-term financial success. By verifying your credit, organizing documents, reducing debt, and choosing the right lender, you position yourself for a smooth approval process and favorable loan terms. Remember, preparation is power. Take the time to get it right, and your dream of homeownership will be one step closer to reality.

Further Reading: