Mortgage application approval tips: 7 Powerful Mortgage Application Approval Tips to Get Your Dream Home

Navigating the mortgage approval process can feel overwhelming, but with the right strategies, you can boost your chances significantly. These mortgage application approval tips are designed to guide you from preparation to final approval—smoothly and successfully.

1. Understand the Mortgage Application Approval Process

Before diving into the application, it’s crucial to understand how lenders evaluate your eligibility. The mortgage application approval process is not just about income—it’s a holistic review of your financial health, creditworthiness, and stability. Knowing what lenders look for helps you prepare effectively and avoid common pitfalls.

What Lenders Evaluate During Approval

Lenders use a combination of quantitative and qualitative factors to assess risk. They don’t just want to know if you can pay—they want to know if you will pay. This evaluation includes your credit score, debt-to-income ratio, employment history, down payment size, and overall financial behavior.

mortgage application approval tips – Mortgage application approval tips menjadi aspek penting yang dibahas di sini.

- Credit Score: A primary indicator of your borrowing reliability.

- Debt-to-Income Ratio (DTI): Measures how much of your monthly income goes toward debt payments.

- Employment History: Lenders prefer stable, consistent income sources.

- Down Payment: Larger down payments reduce lender risk and can improve loan terms.

- Assets and Reserves: Proof of savings or investments shows financial resilience.

The Role of Pre-Approval in the Process

Getting pre-approved is one of the most effective mortgage application approval tips. It’s not a guarantee, but it signals to sellers and agents that you’re a serious buyer. A pre-approval letter from a lender outlines how much you’re likely to borrow based on a preliminary review of your finances.

According to the Consumer Financial Protection Bureau (CFPB), pre-approval can strengthen your offer in competitive markets. It also helps you shop within your budget, avoiding emotional decisions on homes you can’t afford.

“Pre-approval is like a financial passport—it opens doors and shows you’re ready to buy.”

— Mortgage Industry Expert

2. Improve Your Credit Score Before Applying

Your credit score is one of the most critical factors in mortgage application approval. It directly influences your interest rate, loan terms, and even whether you qualify at all. A higher score can save you tens of thousands of dollars over the life of your loan.

mortgage application approval tips – Mortgage application approval tips menjadi aspek penting yang dibahas di sini.

Check Your Credit Report for Errors

The first step is to obtain your credit report from all three major bureaus: Equifax, Experian, and TransUnion. You’re entitled to one free report per year from each via AnnualCreditReport.com. Review them carefully for inaccuracies like late payments you didn’t make, incorrect balances, or fraudulent accounts.

If you find errors, dispute them immediately. The Federal Trade Commission (FTC) states that credit reporting agencies must investigate disputes within 30 days. Correcting errors can boost your score quickly and legally.

Strategies to Boost Your Score Quickly

While building excellent credit takes time, there are fast-acting strategies to improve your score before applying:

mortgage application approval tips – Mortgage application approval tips menjadi aspek penting yang dibahas di sini.

- Lower Credit Utilization: Aim to use less than 30% of your available credit, ideally under 10%. Pay down balances or request credit limit increases (without spending more).

- Become an Authorized User: Ask a family member with good credit to add you to their account. Their positive history can reflect on your report.

- Pay Bills on Time: Set up automatic payments to avoid missed due dates.

- Avoid New Credit Applications: Each hard inquiry can slightly lower your score. Wait until after your mortgage is approved to open new accounts.

For example, reducing your credit card balance from 80% to 20% utilization can increase your score by 20–50 points in one billing cycle.

3. Reduce Your Debt-to-Income Ratio (DTI)

Your DTI ratio is a key metric lenders use to determine if you can manage monthly mortgage payments alongside existing debts. It’s calculated by dividing your total monthly debt payments by your gross monthly income. Most lenders prefer a DTI below 43%, though some programs accept higher ratios.

Calculate Your Current DTI

To calculate your DTI, add up all monthly debt obligations: credit cards, car loans, student loans, personal loans, and any other recurring payments. Then divide that sum by your gross monthly income (before taxes).

mortgage application approval tips – Mortgage application approval tips menjadi aspek penting yang dibahas di sini.

For example:

- Monthly debts: $1,200 (credit cards) + $300 (car loan) + $400 (student loan) = $1,900

- Gross income: $6,000

- DTI = $1,900 ÷ $6,000 = 31.7%

This DTI is well within the acceptable range for most lenders.

Ways to Lower Your DTI Before Applying

If your DTI is too high, consider these actionable steps:

- Pay Off High-Interest Debt First: Use the avalanche method to tackle debts with the highest interest rates.

- Consolidate Debt: A personal loan or balance transfer card can simplify payments and reduce interest costs.

- Delay Large Purchases: Avoid financing new cars or appliances before applying for a mortgage.

- Increase Income: Take on a side gig or freelance work to temporarily boost income for DTI calculation purposes.

Even a small reduction in DTI can improve your loan eligibility and interest rate offers.

mortgage application approval tips – Mortgage application approval tips menjadi aspek penting yang dibahas di sini.

4. Gather and Organize Financial Documents Early

One of the most overlooked mortgage application approval tips is document preparation. Lenders require extensive paperwork to verify your income, assets, and identity. Being unprepared can delay approval or even lead to rejection.

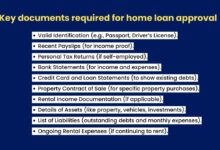

Essential Documents for Mortgage Approval

Here’s a checklist of documents you’ll likely need:

- Recent pay stubs (last 30 days)

- W-2 forms (past two years)

- Bank and investment account statements (last 2–3 months)

- Tax returns (past two years, especially if self-employed)

- Proof of additional income (bonuses, alimony, rental income)

- Government-issued ID (driver’s license, passport)

- Proof of address (utility bill, lease agreement)

- Gift letters (if receiving down payment help)

For self-employed borrowers, documentation is even more critical. Lenders often require two years of tax returns and profit-and-loss statements to verify consistent income.

mortgage application approval tips – Mortgage application approval tips menjadi aspek penting yang dibahas di sini.

How to Organize Your Paperwork Efficiently

Create a digital and physical folder labeled “Mortgage Application.” Scan and save all documents in PDF format, organized by category. Use clear filenames like “W2_2023_JohnDoe.pdf” or “BankStatement_Chase_March2024.pdf.” This makes it easy to upload files quickly when your lender requests them.

According to FDIC guidelines, organized applicants experience faster processing times and fewer follow-up requests, reducing stress and delays.

“The difference between a smooth approval and a rejected application often comes down to paperwork. Be ready before you apply.”

— Loan Officer, 15+ Years Experience

5. Choose the Right Mortgage Lender and Loan Type

Not all lenders are created equal. Your choice of lender and loan program can significantly impact your approval odds, interest rate, and overall experience. This step is often underestimated in mortgage application approval tips, but it’s one of the most impactful.

mortgage application approval tips – Mortgage application approval tips menjadi aspek penting yang dibahas di sini.

Compare Lenders: Banks vs. Credit Unions vs. Online Lenders

Each type of lender has pros and cons:

- Traditional Banks: Offer stability and in-person service but may have stricter requirements.

- Credit Unions: Often provide lower rates and personalized service, especially for members.

- Online Lenders: Fast processing, competitive rates, and user-friendly platforms (e.g., Rocket Mortgage, SoFi).

Shop around and get quotes from at least three lenders. Use tools like Zillow’s mortgage comparison tool to evaluate rates and fees side by side.

Understanding Loan Types: FHA, Conventional, VA, USDA

Different loan programs have different eligibility criteria:

mortgage application approval tips – Mortgage application approval tips menjadi aspek penting yang dibahas di sini.

- FHA Loans: Backed by the Federal Housing Administration; require as little as 3.5% down; more lenient credit requirements (minimum 580 score).

- Conventional Loans: Not government-backed; typically require 5–20% down; better rates for strong credit.

- VA Loans: For veterans and active military; 0% down, no PMI, and competitive rates.

- USDA Loans: For rural homebuyers; 0% down, income limits apply.

Choosing the right loan can make the difference between approval and denial, especially if you have limited savings or credit challenges.

6. Avoid Common Mistakes That Delay Approval

Even with good credit and income, simple missteps can derail your mortgage application. These mistakes are preventable with awareness and planning—key components of smart mortgage application approval tips.

Don’t Make Large Purchases Before Closing

Buying a new car, furniture, or appliance on credit can increase your DTI or trigger a hard inquiry, both of which may disqualify you. Lenders often recheck your credit and employment status just before closing. A sudden change can raise red flags.

mortgage application approval tips – Mortgage application approval tips menjadi aspek penting yang dibahas di sini.

One borrower lost their approval after financing a $4,000 home theater system two weeks before closing. The new debt pushed their DTI over the limit. Always consult your lender before making big financial moves.

Don’t Change Jobs or Quit Without Warning

Lenders value employment stability. Switching jobs, especially to a different industry or from salaried to commission-based pay, can complicate income verification. If you must change jobs, try to stay within the same field and avoid gaps in employment.

For example, moving from a $75,000 salaried role to a $90,000 commission-based job may look good on paper, but lenders may average your income or require a longer employment history in the new role.

mortgage application approval tips – Mortgage application approval tips menjadi aspek penting yang dibahas di sini.

“We’ve seen approvals fall through because someone switched jobs for a ‘better opportunity’ two weeks before closing. Stability matters more than you think.”

— Mortgage Broker, Top 1% Nationally

7. Work with a Knowledgeable Mortgage Advisor

One of the most powerful mortgage application approval tips is to partner with a skilled mortgage advisor or loan officer. They can guide you through complex requirements, recommend the best loan products, and advocate for you during underwriting.

How a Mortgage Advisor Can Improve Your Approval Odds

A good advisor does more than process paperwork—they act as your strategist. They can:

- Identify the best loan program for your financial profile.

- Help you time your application for maximum impact.

- Explain complex terms like “amortization,” “escrow,” and “loan-to-value ratio.”

- Negotiate with underwriters if issues arise.

They may also spot red flags before you apply, giving you time to fix them. For instance, they might notice a thin credit file and suggest building credit with a secured card months in advance.

mortgage application approval tips – Mortgage application approval tips menjadi aspek penting yang dibahas di sini.

Questions to Ask When Choosing an Advisor

Not all advisors are equal. Ask these questions to find the right fit:

- How many mortgage applications have you processed in the last year?

- What loan programs do you specialize in?

- Can you provide references from past clients?

- How do you communicate during the process—email, phone, app?

- What are your typical closing timelines?

A responsive, experienced advisor can shorten your approval timeline by weeks and save you money in the long run.

8. Maintain Financial Stability During the Approval Process

Approval isn’t final until the loan closes. Many borrowers make the mistake of thinking the hard part is over after submitting their application. In reality, the lender continues to monitor your financial behavior.

mortgage application approval tips – Mortgage application approval tips menjadi aspek penting yang dibahas di sini.

Keep Your Finances Consistent

Continue paying bills on time, avoid opening new credit lines, and maintain steady employment. Even a single late payment during the approval window can trigger a denial.

Lenders may re-pull your credit report and verify employment days before closing. Any negative changes can result in last-minute rejection, which is both stressful and costly.

Respond Promptly to Lender Requests

When your lender asks for additional documents or clarification, respond within 24–48 hours. Delays in communication are one of the top reasons for extended processing times.

mortgage application approval tips – Mortgage application approval tips menjadi aspek penting yang dibahas di sini.

Set up email alerts or use a mortgage app to stay on top of requests. Being proactive shows lenders you’re reliable and serious about closing.

9. Understand How Down Payment and Loan-to-Value Ratio Affect Approval

Your down payment isn’t just about upfront cost—it directly impacts your loan-to-value (LTV) ratio, which lenders use to assess risk. A higher down payment lowers your LTV, making you a more attractive borrower.

How Much Should You Put Down?

While 20% is the traditional benchmark to avoid private mortgage insurance (PMI), many programs allow lower down payments:

mortgage application approval tips – Mortgage application approval tips menjadi aspek penting yang dibahas di sini.

- FHA: 3.5%

- Conventional with PMI: 3–5%

- VA and USDA: 0%

However, putting down more than the minimum can strengthen your application, especially if other areas (like credit score) are borderline.

The Impact of PMI on Your Mortgage

Private Mortgage Insurance (PMI) protects the lender if you default. It’s typically required for conventional loans with less than 20% down. PMI adds $50–$300 monthly to your payment, depending on loan size and credit score.

The good news? PMI can be removed once you reach 20% equity in your home. Some lenders offer “lender-paid” PMI in exchange for a slightly higher interest rate—this might be worth it if you plan to stay in the home short-term.

mortgage application approval tips – Mortgage application approval tips menjadi aspek penting yang dibahas di sini.

10. Prepare for the Underwriting Process

Underwriting is the final and most rigorous stage of mortgage application approval. During this phase, a lender’s underwriter reviews all your documents, verifies information, and assesses risk. Understanding this process helps you anticipate requests and respond effectively.

What Happens During Underwriting?

The underwriter checks:

- Accuracy of income and employment

- Consistency of bank statements (no large unexplained deposits)

- Property appraisal value vs. purchase price

- Debt obligations and credit history

- Reserves (savings after closing)

If everything checks out, you’ll receive “clear to close.” If not, you may get a “suspended” or “denied” status, often due to missing documents or discrepancies.

mortgage application approval tips – Mortgage application approval tips menjadi aspek penting yang dibahas di sini.

How to Respond to Underwriting Conditions

Most approvals come with conditions, such as:

- Providing a letter of explanation for a late payment

- Verifying a large deposit

- Submitting updated pay stubs

Treat every condition seriously. Respond quickly with accurate documentation. Your loan officer can help you interpret requests and avoid missteps.

“Underwriting isn’t a test you pass or fail—it’s a negotiation. Be prepared, be honest, and be responsive.”

— Senior Underwriter, National Lender

What if my mortgage application is denied?

mortgage application approval tips – Mortgage application approval tips menjadi aspek penting yang dibahas di sini.

If your application is denied, the lender must provide a reason under the Equal Credit Opportunity Act (ECOA). Common reasons include high DTI, low credit score, or insufficient income. You can reapply after addressing the issue, or appeal the decision with additional documentation.

How long does mortgage approval take?

On average, mortgage approval takes 30–45 days. Pre-approval can happen in 1–3 days. Delays often stem from incomplete paperwork, appraisal issues, or underwriting backlogs.

mortgage application approval tips – Mortgage application approval tips menjadi aspek penting yang dibahas di sini.

Can I get a mortgage with a low credit score?

Yes, but options are limited. FHA loans accept scores as low as 580 with 3.5% down. Some lenders offer “non-prime” or “portfolio” loans for borrowers with credit challenges, though rates are higher.

Should I pay off all debt before applying?

Not necessarily. Focus on high-interest debt and accounts that affect your DTI. Paying off a car loan or credit card can help, but don’t drain your savings—lenders want to see reserves.

Can I apply for a mortgage while changing jobs?

Yes, but it’s riskier. Lenders prefer two years of consistent employment. If you’re staying in the same field, many will approve. Commission-based or self-employed borrowers may need additional documentation.

Securing mortgage approval is a journey that demands preparation, discipline, and smart decision-making. These mortgage application approval tips—from boosting your credit score to choosing the right lender—equip you to navigate the process with confidence. By avoiding common pitfalls and staying financially stable, you increase your chances of a smooth, successful approval. Remember, knowledge is power: the more you understand, the better your outcome will be.

Further Reading: