Mortgage loan application for freelancers: 7 Powerful Tips for a Successful Mortgage Loan Application for Freelancers

Navigating the mortgage loan application for freelancers can feel like climbing a mountain without a map. But with the right strategy, proof of income, and lender knowledge, freelancers can secure home loans just like traditional employees—sometimes even better.

Understanding the Unique Challenges of a Mortgage Loan Application for Freelancers

Freelancers face a unique set of hurdles when applying for a mortgage. Unlike salaried employees who can provide two years of W-2s and recent pay stubs, freelancers often deal with fluctuating income, multiple clients, and irregular payment cycles. This unpredictability makes lenders cautious, as they rely heavily on consistent income to assess repayment risk.

Income Variability and Lender Perception

One of the biggest challenges in a mortgage loan application for freelancers is proving stable income. Lenders typically want to see consistent earnings over a two-year period. For freelancers, this can be difficult if income spikes in one year and dips in another. Many lenders use an average of the past two years’ net income from tax returns to determine eligibility.

- Lenders often average the last two years of net self-employment income.

- Large income fluctuations may require additional documentation or reserves.

- Some lenders may exclude years with losses when calculating averages.

“Lenders aren’t against freelancers—they just need more proof that you can repay,” says Greg McBride, Chief Financial Analyst at Bankrate.

Documentation Hurdles in the Mortgage Loan Application for Freelancers

Freelancers must provide more extensive documentation than traditional borrowers. This includes:

- Two years of federal tax returns (personal and business, if applicable)

- 1099 forms from clients

- Year-to-date profit and loss (P&L) statements

- Bank statements showing consistent deposits

- Contracts or letters from clients confirming ongoing work

Some lenders may also request a CPA letter verifying income stability. The more organized your records, the smoother your mortgage loan application for freelancers will be.

Credit Score and Debt-to-Income Ratio Considerations

While credit score requirements for freelancers aren’t different from those for traditional borrowers, a higher score can offset perceived risk. Most lenders prefer a minimum FICO score of 620, but competitive rates start around 740.

Debt-to-income (DTI) ratio is another critical factor. Lenders typically cap DTI at 43%, though some allow up to 50% with strong compensating factors like high credit scores or large down payments.

- DTI is calculated by dividing total monthly debt payments by gross monthly income.

- Freelancers should aim for a DTI below 36% to improve approval odds.

- Reducing credit card balances or delaying large purchases can help lower DTI.

How to Prepare Your Mortgage Loan Application for Freelancers

Preparation is key to a successful mortgage loan application for freelancers. Starting early and organizing your financial records can make the difference between approval and denial.

mortgage loan application for freelancers – Mortgage loan application for freelancers menjadi aspek penting yang dibahas di sini.

Organize Your Financial Records

Begin by gathering at least two years of tax returns, including all schedules (Schedule C for sole proprietors, Schedule E for rental income, etc.). Ensure your income is accurately reported and consistent with your bank deposits.

- Use accounting software like QuickBooks or FreshBooks to track income and expenses.

- Reconcile your bank statements monthly to avoid discrepancies.

- Save all 1099s and invoices from clients.

A clean, well-documented financial history reassures lenders of your reliability.

Stabilize Your Income Before Applying

If your income has been volatile, consider delaying your mortgage application until you’ve established a more consistent earning pattern. Aim for at least six months of steady income before applying.

- Secure long-term contracts or retainer agreements with clients.

- Avoid large one-time projects that inflate income temporarily.

- Consider incorporating or forming an LLC to present a more professional financial profile.

Lenders look for sustainability, not just high earnings.

Boost Your Credit Profile

A strong credit score can open doors to better loan terms and higher approval odds. Check your credit report from all three bureaus (Equifax, Experian, TransUnion) for errors and dispute any inaccuracies.

- Pay down credit card balances to below 30% of their limits.

- Avoid opening new credit accounts before applying.

- Make all payments on time—payment history accounts for 35% of your FICO score.

Consider using a credit monitoring service like AnnualCreditReport.com to track changes.

Best Mortgage Loan Options for Freelancers

Not all mortgage programs are created equal for freelancers. Some are more flexible and better suited to non-traditional income streams.

Conventional Loans with Bank Statement Programs

Many lenders now offer bank statement mortgage programs that allow freelancers to qualify using 12 to 24 months of bank statements instead of tax returns. These are ideal for those who have high deductions or inconsistent reported income.

mortgage loan application for freelancers – Mortgage loan application for freelancers menjadi aspek penting yang dibahas di sini.

- Typically require 12–24 months of personal and/or business bank statements.

- May accept 10–25% of average monthly deposits as qualifying income.

- Often come with slightly higher interest rates or down payment requirements.

For more information, visit Fannie Mae’s website, which outlines eligible bank statement loan criteria.

FHA Loans: A Flexible Option for Freelancers

FHA loans are government-backed and known for their lenient credit and down payment requirements. They are a popular choice for freelancers with lower credit scores or limited savings.

- Minimum down payment of 3.5% with a credit score of 580 or higher.

- Accepts self-employment income with two years of tax returns.

- Allows gift funds for down payment and closing costs.

However, FHA loans require mortgage insurance premiums (MIP), which can increase monthly costs. Learn more at HUD’s official site.

Portfolio Loans and Non-QM Mortgages

For freelancers who don’t fit traditional lending boxes, non-qualified mortgage (non-QM) loans offer alternative pathways. These are often offered by private lenders or portfolio lenders who keep the loans on their books.

- Use alternative income verification methods, including asset depletion models.

- May accept rental income, investment returns, or even cryptocurrency earnings.

- Typically have higher interest rates and stricter down payment requirements (10–20%).

These loans are ideal for high-earning freelancers with complex finances. Explore options at Mortgage Broker News.

Proving Income for a Mortgage Loan Application for Freelancers

Proving income is the cornerstone of any mortgage loan application for freelancers. Since W-2s aren’t an option, you must rely on alternative documentation to demonstrate earning capacity.

Tax Returns and 1099 Forms

Lenders typically require two years of federal tax returns and all accompanying schedules. For freelancers, this usually means Form 1040 with Schedule C (Profit or Loss from Business).

- Ensure your net profit is positive for both years.

- If you had a loss in one year, be prepared to explain it (e.g., startup phase).

- 1099 forms from clients help verify the legitimacy of your income sources.

Some lenders may average your net income over two years to determine qualifying income.

mortgage loan application for freelancers – Mortgage loan application for freelancers menjadi aspek penting yang dibahas di sini.

Bank Statements and Profit & Loss Statements

Bank statements serve as real-time proof of income. Lenders may request 12 to 24 months of personal and business account statements to assess cash flow.

- Highlight consistent deposits from clients or recurring revenue streams.

- Avoid large, unexplained deposits that could be mistaken for loans.

- Provide a year-to-date P&L statement prepared by a CPA or accounting software.

A P&L statement shows your business’s revenue, expenses, and net profit, giving lenders a clearer picture of financial health.

Client Letters and Contracts

Letters from clients confirming ongoing work can strengthen your application. These are especially useful if you’ve recently secured long-term contracts.

- Ask clients to write a brief letter stating your working relationship, payment terms, and expected duration.

- Include copies of signed contracts or retainer agreements.

- Focus on clients with a history of timely payments and stable businesses.

These documents show lenders that your income isn’t just a fluke—it’s sustainable.

Working with the Right Lender for Your Mortgage Loan Application for Freelancers

Not all lenders are created equal when it comes to handling a mortgage loan application for freelancers. Choosing the right one can make the process smoother and more successful.

Find Lenders Specializing in Self-Employed Borrowers

Some mortgage lenders have specific programs for freelancers, gig workers, and self-employed individuals. These lenders understand the nuances of non-traditional income and are more likely to approve your application.

- Look for lenders with “bank statement mortgage” or “self-employed mortgage” programs.

- Check online reviews and testimonials from other freelancers.

- Ask your accountant or financial advisor for referrals.

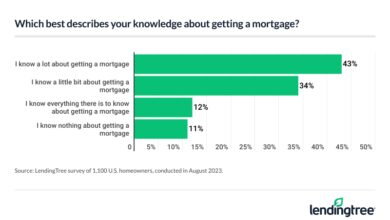

Companies like Rocket Mortgage and LendingTree offer tools to connect you with freelancer-friendly lenders.

The Role of Mortgage Brokers

Mortgage brokers can be invaluable for freelancers. They work with multiple lenders and can shop around for the best rates and terms based on your unique situation.

mortgage loan application for freelancers – Mortgage loan application for freelancers menjadi aspek penting yang dibahas di sini.

- Brokers have access to niche lenders who accept alternative documentation.

- They can guide you on how to present your income effectively.

- Some brokers specialize exclusively in self-employed borrowers.

While brokers charge a fee, their expertise can save you time and money in the long run.

Avoiding Predatory Lenders

Be cautious of lenders who promise “no-doc” or “stated income” loans without proper verification. These are often predatory and can lead to unaffordable payments or fraud allegations.

- Never lie about your income or submit falsified documents.

- Check if the lender is licensed in your state via the NMLS Consumer Access site at nmlsconsumeraccess.org.

- Read all terms carefully and avoid loans with prepayment penalties or balloon payments.

Improving Approval Odds for Your Mortgage Loan Application for Freelancers

Even with solid documentation, freelancers can take proactive steps to boost their chances of approval.

Save for a Larger Down Payment

A larger down payment reduces the lender’s risk and can compensate for income variability. Aim for at least 20% to avoid private mortgage insurance (PMI) and strengthen your application.

- Down payments of 25–30% can lead to better interest rates.

- Use high-yield savings accounts or short-term CDs to grow your down payment fund.

- Consider delaying home purchase to save more if your DTI is high.

Maintain Low Debt Levels

Keep your debt-to-income ratio in check by paying down existing debts before applying. This includes credit cards, car loans, and student loans.

- Aim to pay off high-interest debt first.

- Avoid taking on new debt during the mortgage process.

- Consolidate debt if it lowers your monthly payments and DTI.

Lenders view low debt as a sign of financial responsibility.

Build a Financial Cushion

Having several months of mortgage payments in reserve can reassure lenders that you can handle income dips. This is especially important for freelancers.

- Save 6–12 months of living expenses in liquid accounts.

- Keep reserves in stable accounts like savings or money market funds.

- Document these reserves in your application to show financial stability.

Common Mistakes to Avoid in a Mortgage Loan Application for Freelancers

Even small missteps can derail a mortgage loan application for freelancers. Awareness is the first step to avoiding them.

mortgage loan application for freelancers – Mortgage loan application for freelancers menjadi aspek penting yang dibahas di sini.

Applying Too Soon After Starting Freelancing

Lenders typically require two years of self-employment history. If you’ve just started freelancing, you may not qualify yet.

- Wait until you have two full tax years of self-employment income.

- If transitioning from a job, keep your W-2 income documented during the shift.

- Some lenders may accept one year of self-employment if you’re in the same field.

Mixing Personal and Business Finances

Commingling funds makes it difficult to prove business income. Use separate bank accounts and credit cards for business transactions.

- Open a dedicated business checking account.

- Use accounting software to categorize expenses accurately.

- Regularly transfer profits to your personal account for clarity.

Overestimating Income or Underestimating Expenses

Be realistic about your income and expenses. Overstating income can lead to loan denial or future payment stress.

- Use your tax-verified net income, not gross revenue.

- Factor in taxes, healthcare, and retirement savings when budgeting.

- Plan for lean months when estimating affordability.

Future Trends: How the Mortgage Loan Application for Freelancers Is Evolving

The gig economy is growing, and lenders are adapting. The mortgage loan application for freelancers is becoming more accessible thanks to technological and regulatory shifts.

Rise of Alternative Data in Lending

Lenders are increasingly using alternative data—like bank transaction history, subscription payments, and even social media activity—to assess creditworthiness.

- Platforms like Plaid and Argyle allow secure income verification from digital sources.

- Fintech lenders use AI to analyze cash flow patterns in real time.

- This benefits freelancers with strong digital footprints but inconsistent tax filings.

Expansion of Non-QM and Bank Statement Loans

As traditional lending criteria fail to capture the reality of modern work, non-QM and bank statement loans are gaining traction.

- More lenders are offering these products due to high demand.

- Regulatory frameworks are evolving to support responsible non-traditional lending.

- Expect lower rates and better terms as competition increases.

Increased Financial Literacy Among Freelancers

Freelancers are becoming more financially savvy, thanks to online resources, communities, and tools tailored to independent workers.

- Platforms like HoneyBook and Wave offer integrated accounting and invoicing.

- Financial coaches and podcasts focus on freelancer wealth building.

- Greater awareness leads to better-prepared mortgage applicants.

Can I get a mortgage if I’ve only been freelancing for one year?

mortgage loan application for freelancers – Mortgage loan application for freelancers menjadi aspek penting yang dibahas di sini.

While most lenders require two years of self-employment history, some may approve you with one year if you have prior experience in the same field or a strong employment history before going freelance. Bank statement loans may also be an option.

Do I need a higher down payment as a freelancer?

Not necessarily, but a larger down payment (20% or more) can improve your approval odds and secure better rates, especially if your income is variable.

Can I use freelance income from overseas clients?

Yes, as long as the income is reported on your U.S. tax returns and can be verified through contracts, invoices, or bank statements. Lenders care about legality and consistency, not the client’s location.

What if my income dropped last year?

Lenders typically average income over two years. If last year was lower, be prepared to explain the reason (e.g., pandemic, career shift) and show signs of recovery, such as new contracts or increased bookings.

Are there mortgage programs specifically for freelancers?

mortgage loan application for freelancers – Mortgage loan application for freelancers menjadi aspek penting yang dibahas di sini.

While there’s no official “freelancer mortgage,” many lenders offer bank statement loans, non-QM loans, or self-employed programs tailored to independent workers. These are the closest equivalents.

Securing a mortgage as a freelancer is challenging but entirely achievable with the right preparation. By understanding the unique requirements of a mortgage loan application for freelancers, organizing your financial records, choosing the right lender, and avoiding common pitfalls, you can turn your homeownership dream into reality. The key is consistency, transparency, and proactive planning. As the lending landscape evolves to embrace the gig economy, freelancers have more opportunities than ever to build wealth through real estate.

Further Reading: